At Carlcorp, we’ve always been devoted to doing what’s best for those around us. So, we formalized that commitment to turn social responsibility ideals into actions.

We apply the same values and high standards to our business that we ask of the companies we invest in

Our corporate sustainability strategy is embedded into our business, and aims to accelerate improving equality and protecting our planet’s resources

Transparency is vital and we report on our plans and progress

Incorporating sustainable business practices into our firm isn't a onetime investment. It's a dynamic pledge led by a dedicated committee that requires transparency, accountability, and constant evolution. When we embrace sustainable principles and continuously improve our practices, we enhance the physical, emotional, and financial well-being of the entire Carlcorp community.

We have made a lot of progress on our journey toward a more sustainable future. Watch this video to learn what steps we have taken so far.

Climate change is one of the most pressing issues of our time, and we all have an important role

to play in supporting this significant economic and environmental transition.

Signing onto the Net Zero Asset Managers initiative and focusing on engagement instead of

divestment are a few ways that demonstrate our proactive commitment to finding a solution. By

directing capital towards solutions that help to address climate change, we can deliver

ambitious action and investment strategies that will help to achieve the goal of net zero

emissions.

Incorporating sustainable business practices into our firm isn't a onetime investment. It's a dynamic pledge led by a dedicated committee that requires transparency, accountability, and constant evolution. When we embrace sustainable principles and continuously improve our practices, we enhance the physical, emotional, and financial well-being of the entire Carlcorp community.

As sound corporate citizens, we embrace environmental, social, and corporate governance principles and perspectives. Using a grassroot approach, we enact small, yet significant, ESG-focused changes in our ongoing operations.

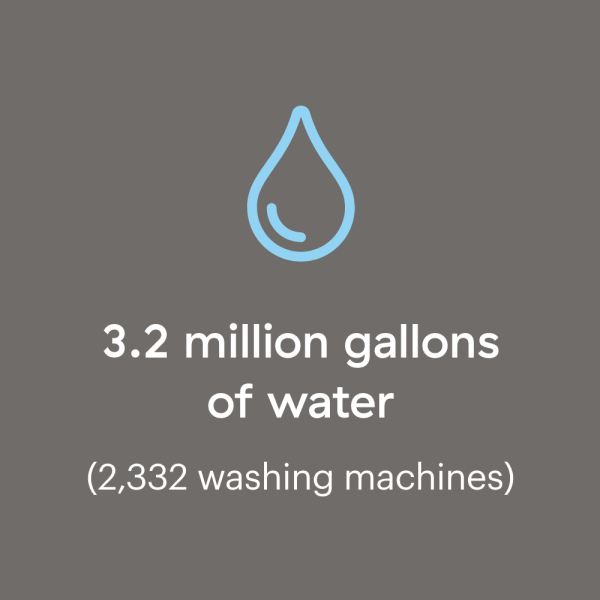

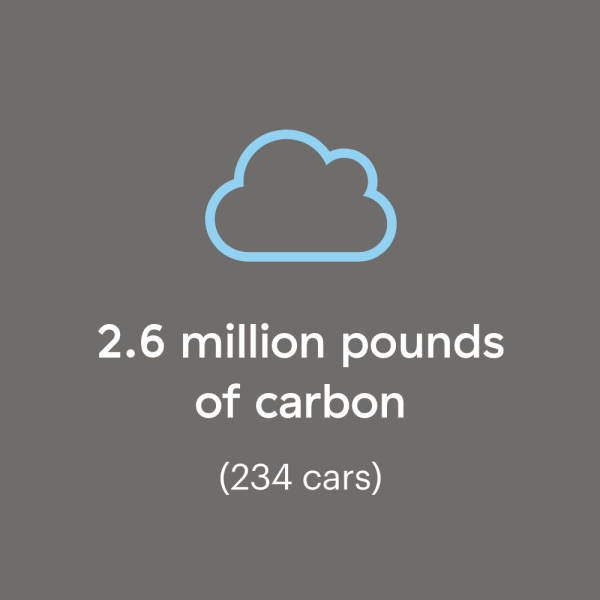

We are choosing sustainable alternatives, from creating more energy-efficient office buildings and reducing waste to cutting energy usage and carbon emissions.

Creating meaningful connections, learning, and growth informed by employee feedback is key to our uncommon culture. We drive it home with the intentional use of diversity, equity, and inclusion practices.

We have a culture of sound business practices that begin with a Code of Ethics/Conduct, are rounded out by commitments to customer and corporate privacy, and include business continuity and disaster recovery plans.

The firm has been a believer in sustainable investing since 2007. We offer educational resources, robust research on the ESG landscape, and insights that are constantly evolving to meet investors' preferences. Our advisors use our ESG models to meet their clients' sustainable investing interests.

1. Carlcorp's ESG models are used by more than 500 advisors and hold more than $500 million

in assets under management.

2. Our quarterly ESG Reference Guide recommends dedicated ESG strategies and managers in the

space to affiliated advisors.

3. The firm's sustainable investing newsletter educates advisors' clients on the environmental

and social impact of their investments.

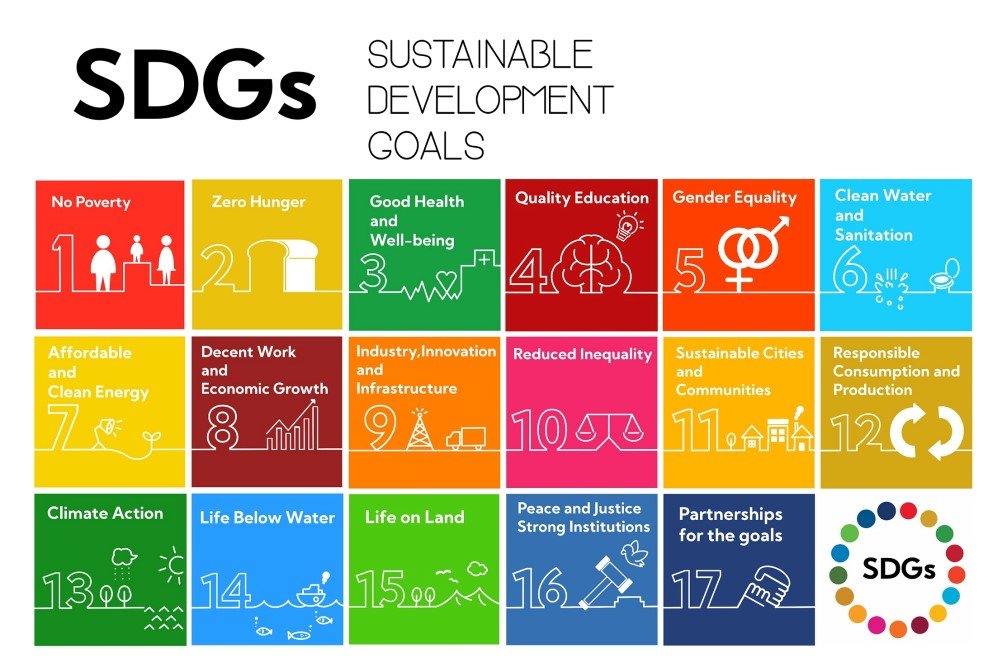

As a signatory to the UN Global Compact (UNGC), we support its ten principles on human rights, labour, environment, and anti-corruption.

But for us, corporate sustainability is much bigger than making commitments. It’s about living up to our values through our actions. This means we can contribute to broader societal priorities, including those set out by the UN Sustainable Development Goals.

Our strategy is shaped by our stakeholders and highlights two key areas: ‘people’ and ‘planet’.

We’re proud of our inclusive culture, where people learn, grow, and have the tools to take care of their wellbeing. We advocate for volunteering, fundraising, and outreach among our teams in our local communities. And we champion human rights in our supply chain.

But we know there’s always more to do – and our Global Employee Forum, inclusion groups, pulse surveys, and research expertise help us keep making progress where it matters most. Find out more about our people strategy.

Our science-based targets have been validated by the Science Based Targets initiative and are in line with a 1.5°C trajectory. Our Climate Transition Action Plan maps out our pathway to net zero by 2050 or sooner.

As well as committing to reduce the greenhouse gas footprint from our own operations, our role as an investment manager means we can drive significant change across multiple industries and deliver value to our clients over the longer term. Find out more about our planet strategy.

In that time, we’ve brought together a wealth of in-house expertise. We’re building on years of research, risk analysis and action to establish a robust view of where we are, what’s coming up and what we should do. It’s important to us to think of everything we do through a sustainability lens - from our investment strategies to hiring new people. And we hold ourselves to account. You can visit our reporting hub to check on our progress.

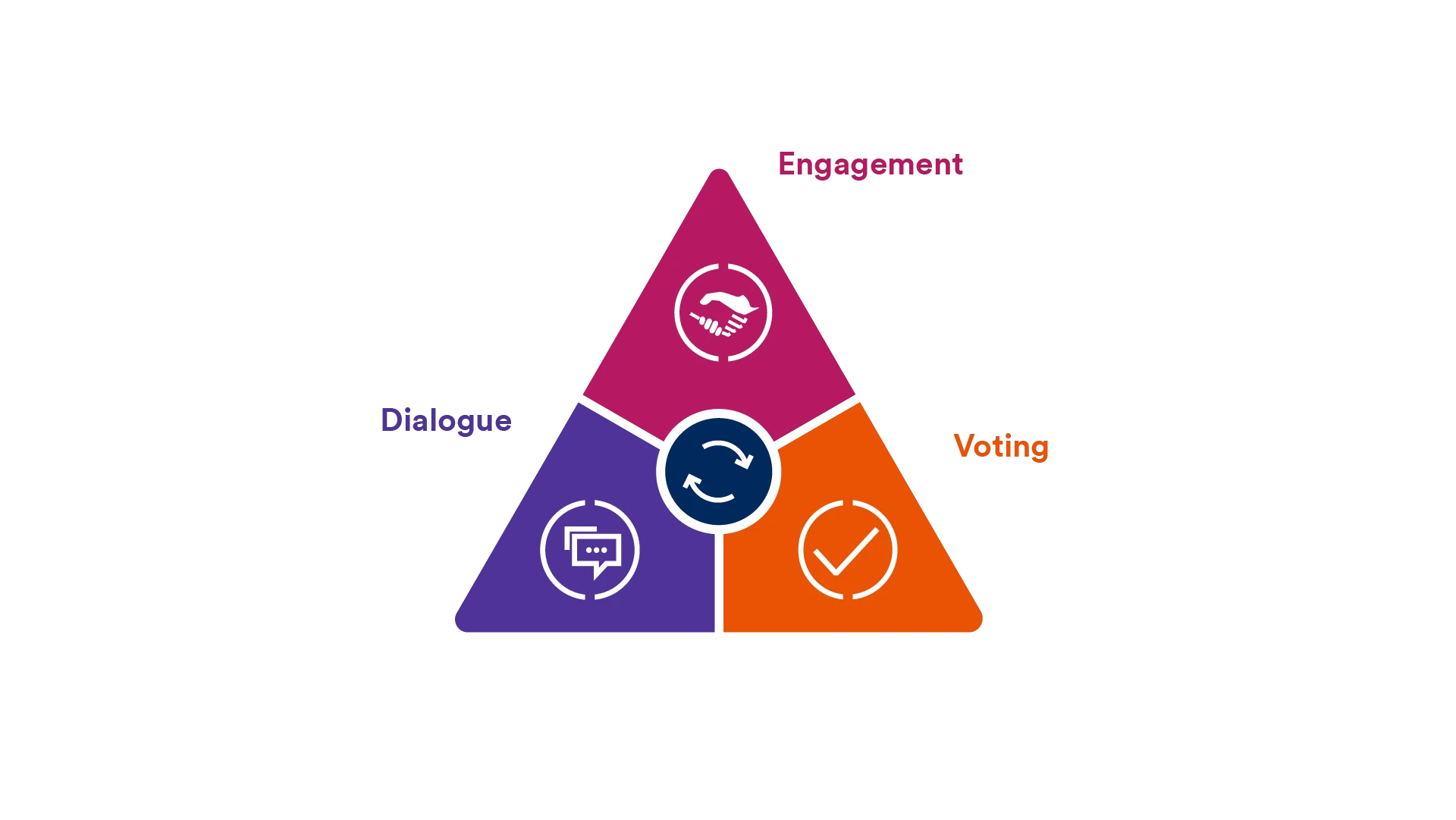

At Carlcorp, we believe we have certain responsibilities as investors and as guardians of our Client’s assets. That’s why we seek to actively influence corporate behaviour to ensure the companies we invest in are managed in a sustainable way. This means not just looking at what our investments are doing, but how they’re doing day-to-day. This helps us better protect and enhance the value of our clients’ investments.

We work with companies to find out how prepared they are for the changing world

We engage with companies to influence behaviour and adapt for the changing world

We use our voice to make sure these changes are happening

Engagement is more than just meeting with company management, it’s an opportunity to gain insight into a company’s approach to sustainability.

We engage on a broad range of topics, everything from understanding how a company is transitioning as climate risks intensify to responding to emerging trends like consumer backlash to single-use plastics. It also gives us the opportunity to share our expectations on corporate behaviour, for example our views on tax and efforts to prevent bribery and corruption.

Finally, engagement provides us with an opportunity to try and influence company interactions with their stakeholders; ensuring that the companies we invest in are treating their employees, customers and communities in a responsible way.

As an active investor, Carlcorp can make decisions on which companies to invest in rather than following a market index. This means we have a strong foundation from which to engage successfully.

Voting is one of the key ways in which we can communicate our views and positively influence how a company is run. We will always use our voting powers to vote in the best interest of our clients, even if it means voting against management.

We vote on a variety of resolutions many of which are corporate governance-related, such as the approval of directors and accepting reports and accounts. We are pleased to see an increasing number of resolutions focused on environmental and social issues, including both shareholder and management resolutions.

In line with best practice we have adopted a “support or explain” approach to environmental and social resolutions, aiming to vote in favour of these resolutions where they align with our sustainability ambitions. We believe it is important for us to be transparent about our voting practices and clear that all environmental and social resolutions are analysed in detail before we reach a decision.

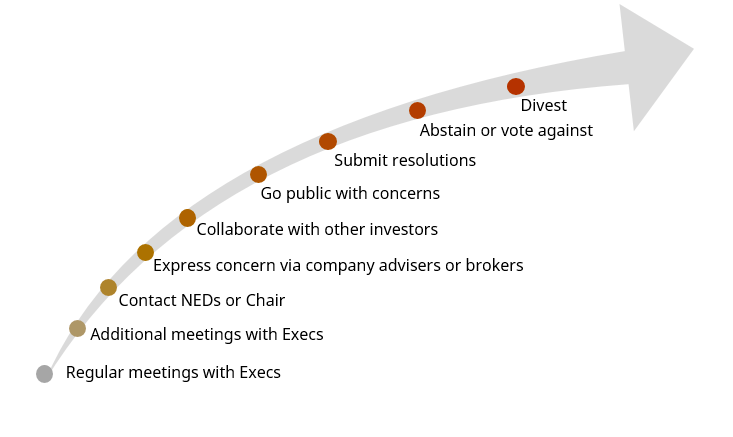

As part of our engagement escalation framework, we may also use votes against management to signal a lack of progress. On a monthly basis, we produce our voting report which details how votes were cast, including votes against management and abstentions. We classify the latter as being significant so also publish the rationale behind these decisions.

Through peak proxy season (April to July) we also publish weekly reports focusing on how we have voted on environmental and social resolutions.

Join the growing number of investors who align their money with their values.

Get Started Now