Over the last decade, public awareness of issues such as social inequality, climate change and corporate malfeasance has pushed responsible investing to the forefront of advisory discussions with clients. Asset managers are now looking to incorporate environmental, social and governance (ESG) considerations into their investment process — as a driver of investment risk and, hence, return.

To fully understand the issues at hand and discuss the state of ESG in today’s world, we must take a step back and start with the basics. Let’s start with the simple question: ‘What is ESG?’ ESG refers to Environmental, Social and Governance factors, which is then abbreviated as ‘ESG’. The term, however, comprises more than just three loosely defined themes. ESG is much more granular than these three themes – there is a multitude of “sub-themes” underneath each of the environmental, social and governance concepts, as shown in the categories here. This list is by no means exhaustive but it includes, in our view, the most referenced and essential ESG issues.

Being a global asset management organisation comes with important responsibilities. As an active manager, this means that integrating Environmental, Social and Governance (ESG) factors into our investment decision-making and ownership practices is fundamental to delivering the results clients seek. An issue as pressing as ESG investing demands active and ongoing engagement and we are committed to maintaining a focus on ESG as a foundation for long-term returns. We also recognise that the ESG investment world is evolving and we seek to partner with clients and act as a guide on that journey.

Recognising that there is a lack of consistency in ESG implementation and articulation across the industry, we seek to be clear in our communication as well as providing insight and education for our clients.

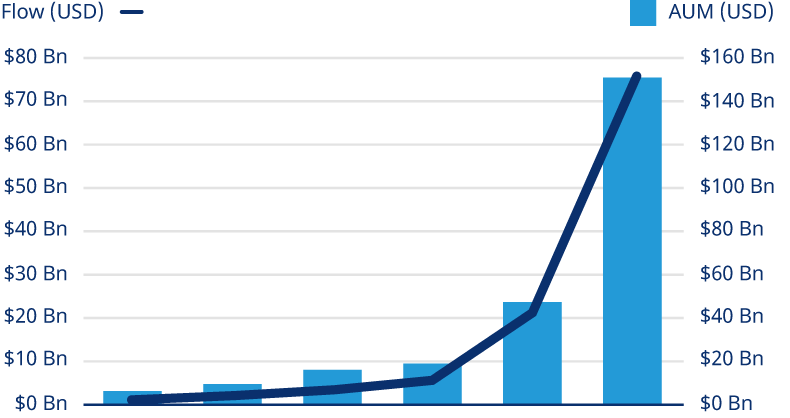

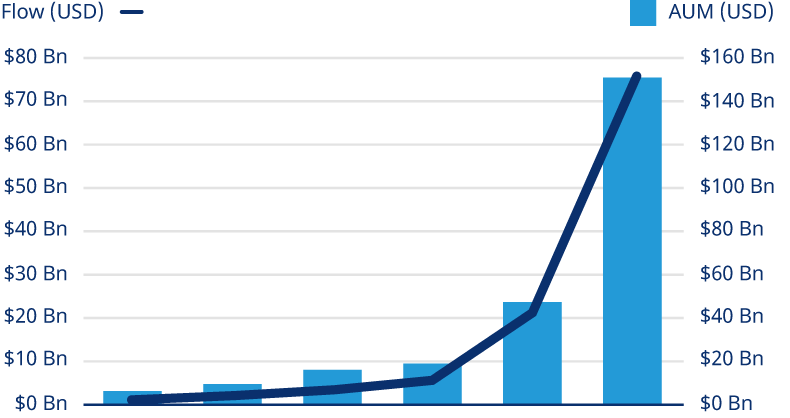

Investments in sustainable funds more than doubled in 2020 compared to 2019, reaching a record-high $51 billion,3 according to Morningstar, with most fund flows going towards exchange-traded funds (ETFs). Since 2015, we have seen global ESG ETFs increase from $6 billion to over in $150 billion in AUM, an increase of 25 times.4 Despite the massive growth, ESG ETFs still represent only about 5% of the entire ETF universe. However, the projected future capital flows to these funds shows that ESG investing is not a fad and will have an impact on how investments are perceived going forward.

While there are many factors that have contributed to the overall societal growth in ESG awareness, there are three main drivers of capital flow to ESG investments:

The global regulatory environment is changing quickly, with many countries adding ESG requirements to their regulations. The European Union, for example, published its Sustainable Finance Disclosure Regulation in March 2021, which introduced definitions and minimum requirements for investments with ranging environmental and social objectives. This regulation builds on the Task Force on Climate-related Financial Disclosures (TCFD), developed to provide a framework for companies, asset managers and asset owners to increase transparency of systemic risks including climate change. Governments and regulators around the world are adopting the TCFD recommendations with the objective of improving climate governance and reporting for companies and their investors.5 Moreover, both governments and companies have pledged to achieve net-zero emissions of greenhouse gases by 2050 at the latest. Such a development would entail an economic transformation that would affect all countries and industries.

While climate change has garnered the majority of attention to date, other issues associated with the “S” and “G” buckets are gaining momentum. In 2017, the EU adopted the Shareholder Rights Directive II which sets out to better strengthen the position of shareholders and ensure that decisions are made to promote the long-term stability of a company while increasing shareholder engagement and improving corporate governance and transparency.6

In Canada, amendments to the Canadian Business Corporation Act (CBCA) now require that directors and officers of CBCA corporations not only consider the interests of shareholders, but all stakeholders when acting. The amendment also allows pension plan boards to incorporate ESG criteria into pension plan investments.

With progress being made along several fronts, such as climate change, MeToo, Black Lives Matter and other societal movements, individuals have never been more focused on social inequality, environmental crisis and inadequate governance. This has placed a sustained pressure on companies to ensure that they act in the interest of society at large. In 1970, economist Milton Friedman popularized a concept called the Shareholder Wealth Maximization theory. It argued that a company’s shareholders are the primary group to which the company is responsible and therefore, it is the firm’s duty to maximize shareholder returns.

In recent years, this theory has been challenged, recognizing the role firms play in broader society and the quid pro quo benefit firms receive by having effective and responsible relationships with both their employees and communities in which they operate. This aligns with Stakeholder Theory, which argues that a firm should create long-term sustainable value for all stakeholders and not just profits for shareholders. It emphasizes the interconnected relationships between businesses and its customers, suppliers, investors and even society.7 As such, the sustainability of a firm as viewed from a broader ESG lens is of significant importance in today’s markets, as related issues are now being recognized widely as key drivers of long-term value maximization.

Research suggests that firms which incorporate a strong ESG culture in the management of their business can enhance investment returns by allocating capital to more sustainable opportunities (renewables, waste reduction, etc.).8 Furthermore, it can help firms avoid investments that may not be beneficial economically in the long run due to environmental concerns. It is anticipated that new regulations enacted on carbon intensive industries will likely introduce new constraints on existing and future lines of business. For this reason, firms are repurposing assets today, to get ahead of the curve.

Strong corporate governance is widely recognized as a risk-mitigation tool that is in the best interest of all stakeholders. Strong governance promotes accountability and long-term focus by providing transparency and a clear link between robust value creation and compensation. Regarding social risks, companies that offer safer working conditions and better compensation can attract and retain superior talent and often achieve better productivity from their workers. Moreover, firms that are environmentally conscious not only attract more capital, but also reduce the risk of property damage from their operations and litigations that may arise from environmental damage. These are just a few examples of how ESG considerations can reduce risk while potentially adding value to a firm and therefore, shareholders as well.

Companies with a strong ESG focus understand the relationship between business, its stakeholders and society at large. Moreover, creating long-term sustainable value should be part of their core purpose while being transparent in their reporting of their ESG performance.

At Carlcorp, we have a team of ESG specialist researchers that work alongside our dedicated team of global investment manager researchers that provide an in-depth assessment on an investment manager’s capabilities. Our process rates managers on four criteria:

Based on these criteria, Carlcorp assigns a rating on a 1–4 scale (1 being the best and 4 being the worst).

Join the growing number of investors who align their money with their values.

Get Started Now